Bodhala hosted its first live webinar on Dec. 10, 2019

Presented by Bodhala team members across Client Success, Marketing, and Product, legal leaders from around the world joined the live webinar. The webinar covered two hot-button topics: using big data analytics to uncover best practices and pitfalls to avoid when negotiating annual rate card increases with outside counsel. We highlight many of those pitfalls in our two new white papers, The Hidden Staircase and The End Of Excel Hell.

The webinar recording and presentation slides are now available here.

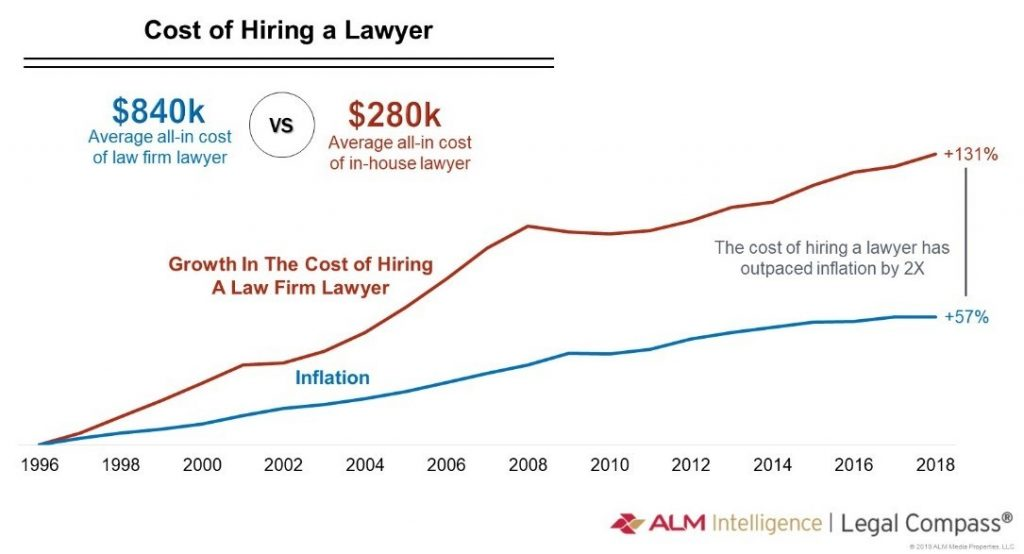

“Big data analytics are revolutionizing how corporate legal departments negotiate with their panel law firms, and we’re glad to share how in this webinar,” said Bodhala SVP & Head of Client Success, John Maloney. “One of the most irritating pain points for our clients is the yearly dread that comes with annual rate negotiations. Bodhala’s free and new rate card RFP platform alleviates that pain by leveraging machine learning to surface the best possible outcome for your legal department.”

Maloney explained that the webinar stemmed from seeing countless clients struggle to negotiate annual rates with panel firms, a process fraught with confusing concepts. Recognizing this universal challenge, Bodhala developed a learning series on RFP rate card negotiation, starting with what we call the “Hidden Staircase” of law firm rates.

Still, several barriers exist to getting the best possible rate, and most of them cannot be easily overcome by legal department staff. Bodhala created a whitepaper to help professionals apply our best practices for rate negotiation and navigate out of “Excel Hell.”

Bodhala’s powerful big data analytics are designed to make these processes easier. Our platform streamlines all of your RFPs in one dashboard, giving your legal department an unparalleled, 360-degree view of past spending and unmatched projection ability for the future.

“Today’s webinar was a huge success and very exciting for us as a business,” said Kyle Johnson, Head of Marketing. “Our unique ability to pull proprietary information out of the Bodhala platform and share it with our audience proved to resonate – as was shown through the lively conversation throughout the presentation.”

Among the interesting questions and discussion points, here are three of the top takeaways from this discussion:

- On average, organizations allocate 75% of their outside counsel spend to seven firms. When focusing on your rate card RFP process this year, focus the bulk of the work on prioritizing your top seven firms.

- According to the audience polls, the majority of companies represented at the webinar did not use a formal rate card RFP process (only 30% did so). Of those that did use a formal process:

- Over half spend somewhere between 40 – 60 hours per RFP.

- The majority have 5 – 10 panel firms.

- The group was split almost evenly between members of the Legal Ops and GC / AGC teams.

- The average outside counsel spend falls into the $25m – $50m range.

- By leveraging Bodhala’s free rate card RFP platform, companies are expected to reduce the time they spend running rate cards by one-tenth (~5 hours) with better results. Those who add on Bodhala’s analytics platform are able to experience even more positive outcomes, keeping their annual spends in check and ensuring compliance by the law firm.

Bodhala is a groundbreaking legal technology platform created by lawyers to transform the half-a-trillion dollar global legal industry. Our platform refines organizational processes by empowering your legal team with deeper insights that allow you to better analyze, interpret, and optimize outside counsel spend, trailblazing a new era of legal market intelligence.

Navigating through confusing concepts like annual rate card RFP negotiations is just the beginning. For more information on how Bodhala can revolutionize your relationship with outside counsel, and how to optimize your legal spend, set up a demo today at https://www.bodhala.com/demo-bodhala.

Like what you’re seeing?

Shoot us an email at [email protected], and let’s talk about how to get started.