Leaning heavily on Bodhala data that exposed trends around law firm rates and accelerating shifts in law firm partnership models, a WSJ analysis highlighted the rapid weakening of partnership at Big Law firms. It’s been replaced by a culture where, in the WSJ’s words, “data and money rule” above everything else.

In this “new normal”, Big Law partners are constantly pushed toward revenue maximization as the predominant driver of the attorney-client relationship, like a doctor being judged on how many patients she can see in a day.

With its one-of-a-kind platform, Bodhala’s insights help arm clients with their own data and tools to combat this new dynamic in the legal service market.

The team had a good moment at HQ last week when WSJ reporter Sara Randazzo pinged us.

She was writing me to let me know that Saturday, almost a year since my fellow co-founder Raj Goyle and I engaged with her on a story idea, The Wall Street Journal would publish her deep-dive look at how elite law firms – “Big Law” – have in recent years begun to restructure their payment and equity plans to drive profit margins and attract and retain top talent.

It really is a fascinating read, made all the more interesting to us here in the office by knowledge that our insight and Bodhala’s data set helped drive the story from start to finish.

Let’s talk about how.

The thesis of the story is based on a trend we’ve seen play out not only anecdotally, but borne out by data measured in our one-of-a-kind Rate Index and our monitoring of firm partnership structures.

After hearing stories about changes in elite law firm partnership practices, we pitched this tip to Sara last year, who took time to develop a fascinating look at rate structures and the changing face of Big Law partners.

By combing through the billions of data points on counsel behavior and billing that Bodhala tracks, we were able to accurately assess and confirm the suspicions of the Journal in its analysis.

I worked at one of these firms, New York-based Simpson, Thacher & Bartlett, and many of the firms that I engaged with on my matters are some of those top-tier targets mentioned in the story.

WSJ frames the shift in an interesting way: trying to transition to build a business in the model of an investment bank-style approach rather than a traditional, and as many say, outmoded, law firm.

While this shift has certainly increased firm’s bottom line and tightened up processes, it changed the nature of the interaction.

A result of this? Our clients would be quick to tell you it’s made interactions less transparent, more frustrating, and certainly more expensive.

Just how expensive?

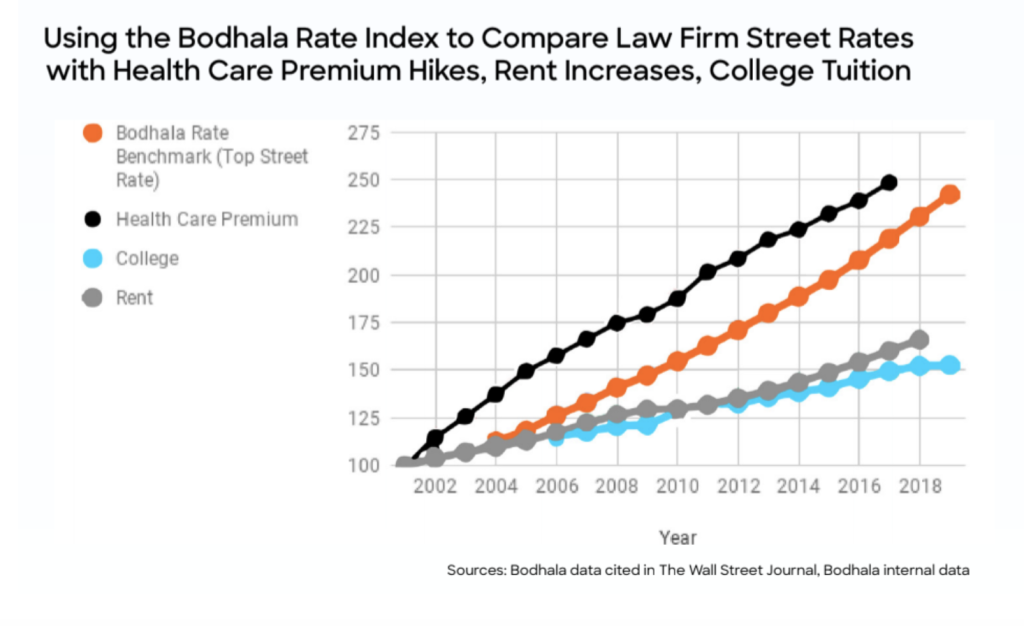

As you can see in the chart above, our data going back to 2000 demonstrates that top hourly firm rates are tracking at almost 4 times the rate of inflation, falling in line with health care cost hikes and outpacing education and housing.

Per our data, top-15-by-revenue firm street rates went from under $700 in 2000 to charging more than $1,650 per hour. Yikes. While one can argue the merits of the shifting focus toward industry profits, no one could argue this is a market-based response.

Now, we’re not suggesting lawyers shouldn’t be profitable, nor do we tell our clients that their firm’s services cannot command a premium. The premise of Bodhala is to use the power of data to make the partnership between a company and their outside firm more transparent, more equitable, and more accountable.

We’ve heard about these issues since the beginning of our company, and so when WSJ called us, we were happy to share our insights and data. We’re glad to be a resource for the Journal, if for no other reason than we hope we can help drive positive change in the industry.

The best result of our findings and investments in data science? This positive change can save a company millions. If you’re interested in learning more about how we came to our findings, or how we can help create more accountability and transparency with your outside firm, shoot us an email so we can get the conversation started.

To learn how Bodhala can help you manage your outside legal spend, request a custom demo here, or email us at [email protected].

Like what you’re seeing?

Bodhala can save your company millions in legal spend with our free billing guidelines