For many corporate legal departments, data analysis is like buying tickets to a cover band for your favorite group and expecting it to be just as good. Sure, the tickets were less expensive but the group is a little pitchy, and they don’t hit the high notes like your favorite lead singer would.

Many corporate legal departments onboard eBilling systems expecting them to play double duty: eBilling plus real-time, data-driven analytics and insights. In almost every case, the legal operations team – and the GC – is disappointed when they realize how long ebilling implementation takes, and that they can’t get the analytics they expected and need.

So what’s the problem? While eBillers can be great at helping you facilitate payments, they are just not set up to deliver accurate analytics or meaningful insights.

Have you ever heard the phrase “garbage-in, garbage-out”? Legal billing data is tricky – it’s inconsistent, mis-tagged or categorized, and many times it’s missing altogether. Sometimes referred to as “bad” or “dirty” data, a messy data set means messy reports and misleading insights.

Unfortunately, eBillers suffer from this garbage-in, garbage-out problem. They don’t do the necessary cleaning and restructuring necessary for accurate reporting, which often leads to poor decisions based on faulty data insights.

Even though eBillers were not purpose-built to surface actionable insights, by layering on a sophisticated legal spend management solution that ingests, cleanses, and enhances your data, you can compound the value of your eBilling investment.

So what’s the impact of “bad” data?

1. Incomplete Narrative on Outside Counsel Spend

It might be easy for you (a human being) to look at an individual invoice and determine that hours billed for ‘Gibson’, ‘Gibson Dunn’, and ‘GDC’ can all be attributed back to the same firm. Computers aren’t as smart. A computer needs the name to be identical to crunch numbers for that firm.

To get your software to do what you need, you would have to make sure that all the mentions of ‘Gibson Dunn’ are the same across all invoices – a near impossible feat to accomplish manually.

As we mentioned, while eBillers are great at facilitating payments, they are not so great at cleansing data. So when you go to an ebiller to crunch numbers – whether about an individual firm or in comparison to other firms, you’re almost certainly not seeing the entire picture. In fact, you might be seeing numbers that relate to less than 25% of invoices per “firm”. The results can be extremely inaccurate and misleading.

You may be thinking, “well, my data is definitely not that bad.” Au contraire, my friend.

Bodhala completes an average of 41,063 law firm name standardization every year – per client. Average annual timekeeper name standardizations per client? 63,552. But don’t fret, you’re not alone. Even the most sophisticated corporate legal teams suffer from this challenge.

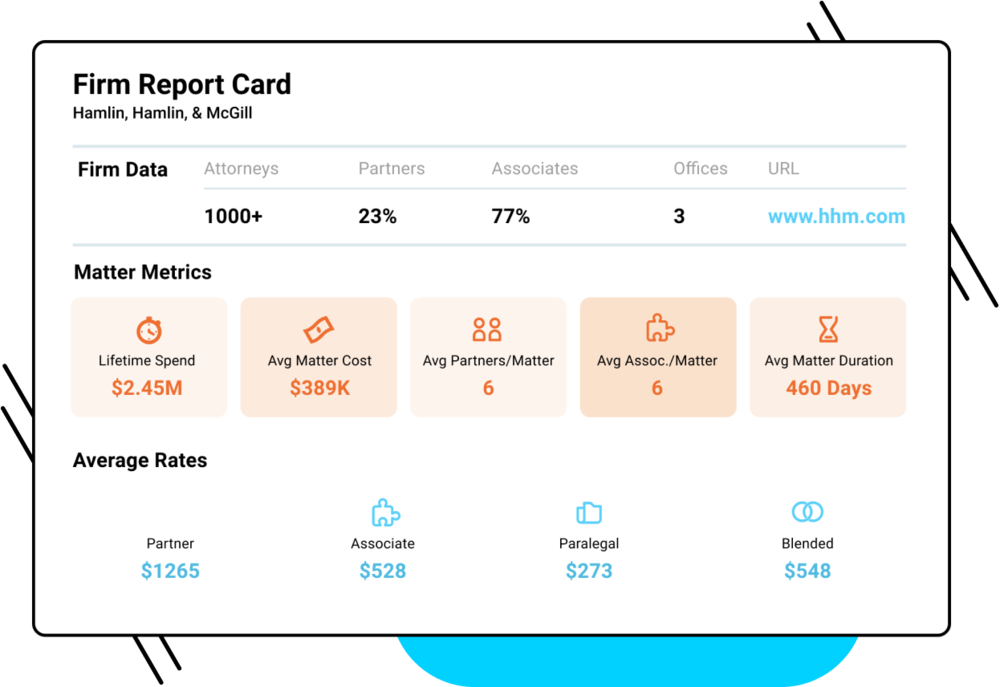

Without cleansing and standardizing your data, it’s tough to to accurately analyze key metrics, such as:

- Average spend per law firm

- Average partner/associate rate per law firm

- Average practice area spend per law firm

These metrics are critical to obtaining a clear picture on your overall outside counsel spend. What’s more, you likely rely on these numbers – and many others – to make your most important strategic decisions. Without accurate insights on these data points, how can you ensure you’re really hiring the right lawyer at the right law firm at the right price?

2. Overpaying for Inexperience

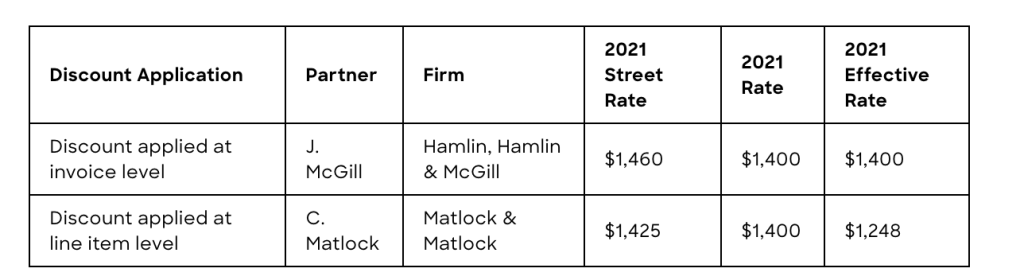

It’s not uncommon for partners at one firm to equate to associates at another firm. Matriculation standards vary from firm to firm, as do business models. And it’s not unheard of for firms to inflate titles to boost billings. This can lead to misleading data for corporate legal departments.

This lack of title standardization prevents true apples-to-apples comparisons, making it really tough to compare ‘partners’ or ‘associates’ from firm to firm.

Without a basis for accurate comparison, how can you confirm that you’re really getting as good of a rate as your law firm claims? Leaving inaccurate timekeeper levels in the mix enables law firms to continue costly antics that rack up your rates and pad their wallets.

Bodhala completes an average of 2,711 timekeeper level corrections per client every year. Those kinds of numbers can make a serious difference in the average partner rates, making accurate comparisons really tough.

By using a system that will normalize timekeeper levels, you can properly model the rates paid to partners versus the rates paid to associates and ensure you’re getting the value you expect and experience you need for your matters.

3. Inaccurate “Should-Cost” for Matters

When it comes to your matters, you need to have realistic expectations of what they will cost. But a lack of standard practice area taxonomy, and missing or mis-tagged practice areas can leave your team in the dark when it comes to benchmarking upcoming matters.

Without standardization and accurate data, it’s impossible to gauge key metrics such as:

- Average practice area spend

- Average matter cost

- Average matter duration

Again – you guessed it – this is an extremely common problem, even for the most advanced legal ops groups. Per client, Bodhala averages 34,131 practice area adjustments every year. But by using AI and machine learning to clean, standardize, and backfill blank practice areas, we enable meaningful analytics and actionable insights. Bodhala even enhances your data, supplementing it with sub-areas and matter tagging for more granular analysis.

So, where do you go from here?

Armed with insights gleaned from clean data, your team can make more strategic decisions, accurately forecast costs, and ensure you stay on budget.

The events of the past year have accelerated corporate legal departments’ need for and reliance on data. But you don’t just need data, you need good data!

—

Get in touch with our team of legal billing and data experts to find out how Bodhala can transform your legal department.