Ever grabbed an extra cookie from the cookie jar as a kid because you knew no one was watching? Or maybe you skipped out on your last set of reps during a workout because, hey, who’s going to know?

Sure, we’ve all been guilty of cutting corners when we know there are no consequences. But did you ever attempt to take that cookie with a parent in the kitchen? We’re guessing you probably wouldn’t risk losing precious screen time over one cookie.

That reaction – not going for the cookie when your parent was right there – is commonly known as the “Sentinel Effect”. The tendency for one’s performance to improve when they know they are being monitored can be observed in all walks of life, both at home and on the job.

The simple act of monitoring – even without applying penalties – is proven to improve behavior. It’s a great passive management technique: show someone you’re monitoring them, and regardless of whether you are actually watching or not, performance will improve.

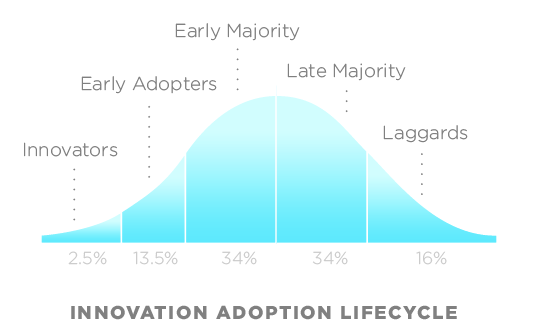

This is especially true when managing outside counsel. Historically outside counsel has operated without the oversight – or even visibility – of their clients. That lack of transparency fostered a situation where not only were guidelines consistently ignored, but sloppy business practices were allowed to fester.

But how do you transparently monitor outside counsel to create the Sentinel Effect?

The answer is simple — data. All the answers you need are right there in your billing invoices; you just have to know how to use it to create not only a feeling of increased accountability but also to stoke that competitive drive within every lawyer.

Armed with data, in-house teams have the power to:

1. Enhance Law Firm Relationships

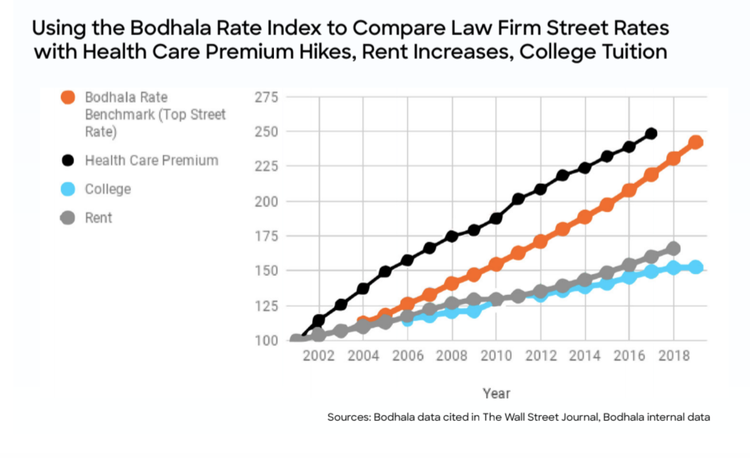

Law firms are retained to act in the best legal interest of the clients, but when it comes to billing, firms are still businesses and can be self-serving. The relationship becomes one-sided as clients are often left as idle price-takers while firms receive hefty paydays.

Having regular meetings with law firms fueled by a variety of quantitative and qualitative metrics, such as billing rates, discounts, and more, will lead to more effective, robust conversations about what’s working well or where adjustments might be needed. By letting the data do the talking, the conversation is much easier – and clients get better results from their firms.

Simple practices such as incorporating firm report cards and quarterly business reviews to regularly discuss KPIs serve as a reminder to your law firms that you’re closely monitoring the value the relationship delivers. Nobody likes a “gotcha” moment, so these regular check-ins can help quickly correct firms’ course of action, leading them to become more disciplined in their billing practices and act as a strategic business partner.

2. Eliminate Inefficiencies

From overstaffing to partners handling associate-level tasks, and everything in between, efficiency isn’t always top of mind to law firms. In fact, there’s a strong possibility that the firm that billed the most hours in your panel may actually be the most inefficient.

Inflated invoices are often the byproduct of inefficiency. But transparency on key metrics, like average partner hours, matter duration, or cost can quickly highlight where inefficiencies rack up the cost of your matters.

Examining and discussing these key metrics with your firms regularly shows that you’re analyzing their efficiency and comparing them to other – potentially more efficient – firms. Your firms don’t want to lose your business, so expect a material boost in productivity and the elimination of inefficient practices. Once you show you’re serious about evaluating performance – and value efficiency – managing your outside counsel effectively will be much easier. By using data to set transparent expectations, you provide a clear roadmap to a stronger relationship.

3. Influence Strategic Decisions

To effectively manage spend you need to think strategically — and to truly think strategically, you need data. Corporate legal departments are increasingly demanding transparency around everything from rates to work allocation to the diversity of timekeepers and more. But visibility isn’t the only thing that data provides.

Armed with apples-to-apples comparisons and data-backed insights, corporate legal departments can take a more informed, strategic approach towards the major decisions that impact their department and the business.

For example, as COVID-19 rapidly accelerated the need to optimize spend and cut costs, many corporate legal departments began to reevaluate their outside counsel spend. Many departments needed to quickly review their rates and obtain rate freezes and discounts from their firms. In turn, this forced competitive firms to follow suit.

4. Drive Down Costs & Increase Savings

Pricing is arguably the most critical part of any business – product or service. By its very nature, pricing is complicated. “Pricing tricks” are a fact of life – that’s true if you’re pricing sneakers or legal services.

Now, it’s no secret that law firms use “pricing tricks” – some more above-board than others – on both rates as well as in the manifestation of those rates; their invoices. From block billing to unapproved rate increases to footing the bill for printing, there’s no doubt you’ve fallen victim to unnecessary costs. But the good news is that you have the power to change this narrative.

By leveraging data to track the performance of your panel firms, you can easily identify the common law firm antics driving up your spend and address them quickly. Using data to show a pattern will, almost miraculously, make certain antics disappear. You may have to negotiate or address other patterns by changing your billing guidelines. Nonetheless, data is your launchpad for not just identifying those antics, but for actioning solutions to them (clawbacks and markdowns, anyone?).

It’s pretty clear that transparency in business – legal or otherwise – has the power to influence performance and drive better outcomes.

But, you don’t have to take our word for it! One of Bodhala’s clients, a major insurance carrier, was having issues with their panel firms consistently exceeding budget on corporate matters. Prior to starting a very large matter merger, the organization’s in-house team worked with Bodhala to create report cards to share with the top firms in their panel. After receiving a detailed analysis of their performance from the insurance carrier, each firm immediately brought down their budget projections significantly.

Without data, you’ll be hard-pressed to hold your law firms accountable for the quality of service you expect. Data sets the foundation for a successful, equitable partnership in which you receive the value you pay for.

So, will you continue to turn your back on the cookie jar or will you leverage data to drive better business outcomes?

—

Get in touch with our team of legal billing and data experts to find out how Bodhala can transform your legal department.