Bodhala works out of a WeWork, owned by the We Company. We get along just fine; it’s a good office space. In our early days, we even worked alongside founder and now-former CEO Adam Neumann in his company’s early flagship space.

Over at the Wall Street Journal, Jean Eaglesham and Eliot Brown dig into the story behind We’s failed IPO. Their story centered around Neumann, once seen as the darling disruptor of the stodgy world of corporate real estate. The 40-year-old billionaire was forced to leave We on Sept. 22.

“We canceled its initial public offering last month after concerns grew among potential investors about its finances and Mr. Neumann’s behavior—leading existing investors to force him out as CEO.”

In addition to Neumann’s outlandish public behavior, the Journal reports he had strong control over what was an incomplete, bungled investor prospectus, rattling potential buyers.

“Numerous current and former We employees believe the IPO prospectus was poorly written and delivered a muddled message about their business. They cite the document’s dedication, “to the energy of we—greater than any one of us but inside each of us.”

Among those burned by the document were white-shoe law firms Skadden Arps Meagher & Flom LLP and Simpson Thacher & Bartlett LLP, who were cited as having helped prepare the prospectus. The story goes on to say, however, “Neumann often rejected the recommendations” of experts – even legal matter experts.

The prospectus “leaves unanswered some basic questions,” with unclear revenue reports, failure to disclose major purchases (like a brand new Gulfstream jet), and no mention of Neumann’s sale of hundreds of millions of We stock. Read the rest here.

This is, of course, a cautionary tale. It’s a bummer to see WeWork paid Big Law prices and the premium advice was ignored. Now we can’t guarantee your CEO will follow good legal advice but we can guarantee that our clients pay a market price for IPO legal advice. In fact, our clients have saved millions when they used Bodhala to select IPO counsel.

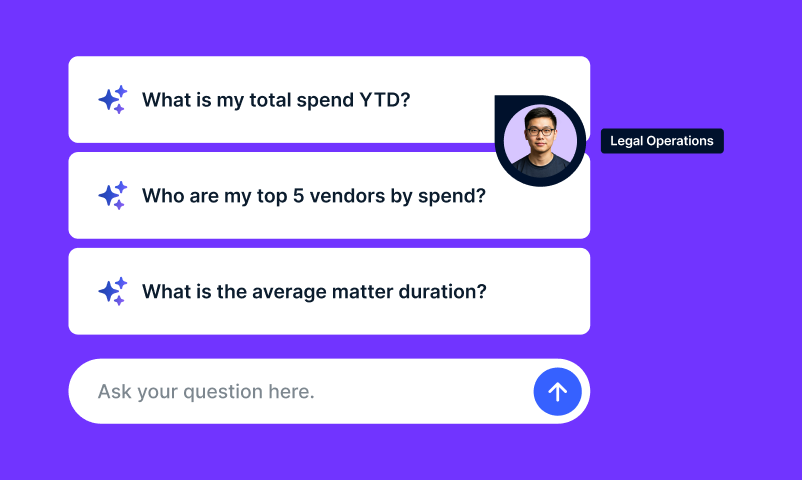

Bodhala is a groundbreaking legal technology platform created by lawyers to transform the half-a-trillion dollar global legal industry. Our platform refines organizational processes by empowering your legal team with deeper insights that allow you to better analyze, interpret and optimize outside counsel spend, trailblazing a new era of legal market intelligence.

Our clients, corporate legal departments, come to us to solve four core problems: a lack of clarity in legal billing and rates, billing reporting miscommunications, the lack of a true apples-to-apples rate comparison for law firms, and the lack of a legal talent marketplace. Bodhala’s product addresses and creates workflows for are the following:

- Legal spend transparency through data cleansing and rate card discount normalization to allow comparison

- Reporting granularity, based on information from your own data

- Rate benchmarking, creating a true price market

- Guided counsel identification, selection, and fit

Bodhala works with your legal department to highlight the right partner at the right firm at the right rate for all of your matters. This means serious savings in time and money for your in-house team and your budget.

Shoot us an email at [email protected], and let’s talk about how to get started.

Dive Deeper

Our system surfaces insights on matters across the legal industry. Check out how Bodhala’s proprietary data helped the Wall Street Journal get the real story in the changing world of elite law partnerships, where data and money rule.